Patient. People with private health insurance need less patience – they get treated much faster. © Getty Images / Yuri Arcurs Production IAURI

Many private health insurance plans in Germany require a high deductible or do not provide the same level of coverage as statutory health insurance. How to find a good plan.

Good and Affordable Coverage for Expats freischalten

Private health insurance in Germany can offer advantages for expats, including faster access to care, tailored coverage and potential cost savings for young, high-earning individuals.

Many insurance comparison sites highlight the cheapest plans – but who takes responsibility for potential coverage gaps? What happens if your policy falls short when you need it most? Often, so-called „top” plans come at a steep price – but are they truly worth it? What good are premium policies if they strain your budget?

We provide you with a carefully curated selection of high-quality insurance plans that offer comprehensive protection at a reasonable cost – striking the right balance between affordability and security.

Independent and unbiased: Stiftung Warentest

Stiftung Warentest is Germany’s best-known consumer organization. We are independent, non-profit and provide fact-based analysis – completely free from intrusive affiliate links. We are funded solely by our readers’ willingness to pay for exclusive content. We receive no commissions, nor do we have any partnerships with insurance providers or other companies beyond data collection.

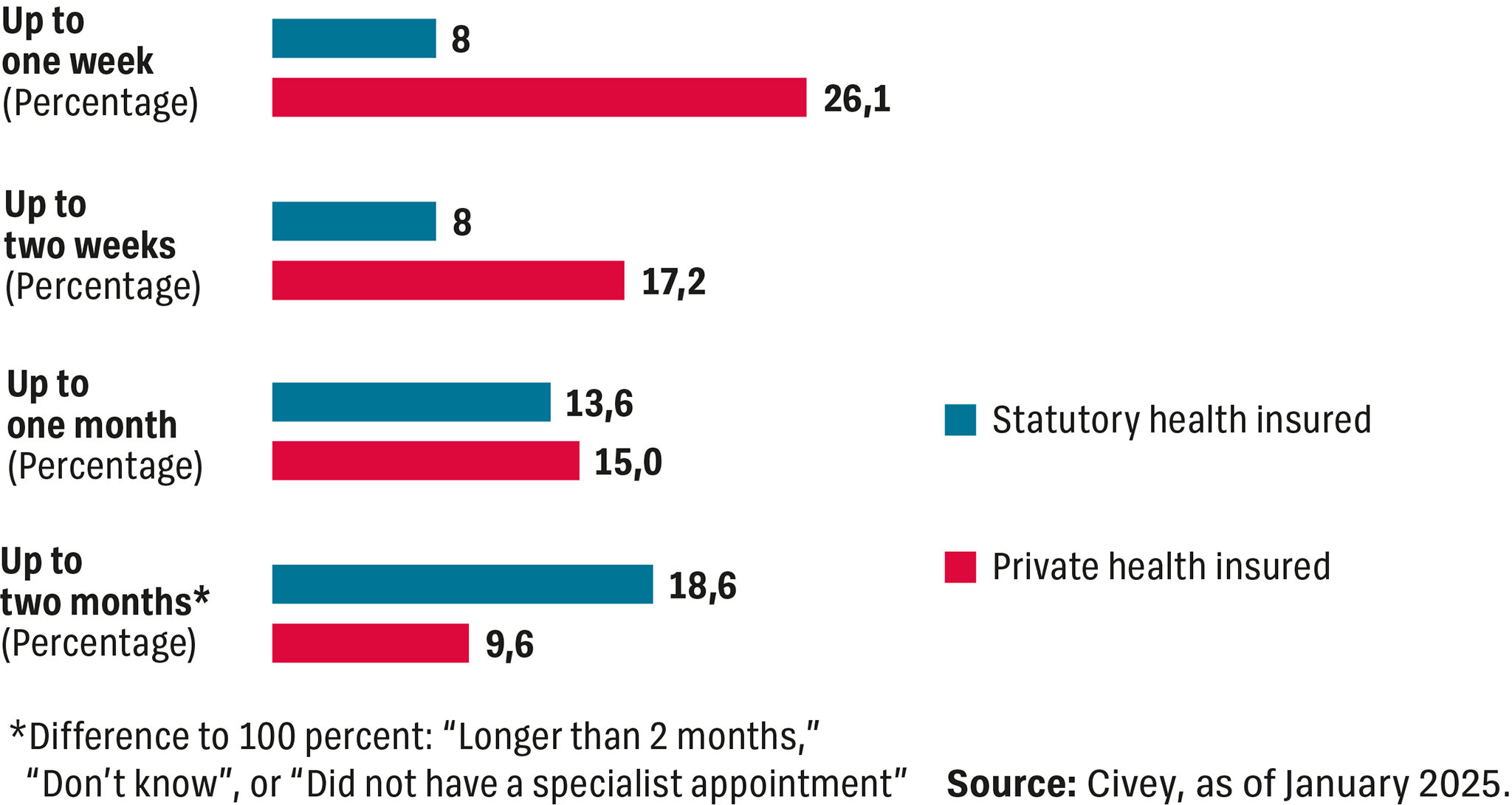

To throw a spotlight on our healthcare system, we commisioned a representative survey to special care. Faster access to specialist care is a critical factor in healthcare systems, with appointment availability playing a key role.

Empirical evidence suggests that privately insured patients receive medical treatment significantly quicker than patients covered by statutory health insurance. Our study supports this finding, indicating that respondents with private insurance reported reduced waiting periods for their most recent specialist appointments.

Representative survey commissioned by Stiftung Warentest among 5,014 German citizens aged 18 and older, conducted from January 10 to 12, 2025. Individuals were asked how long they had to wait for their last appointment with a specialist in the past 12 months. Source: Civey, as of January 2025. © Stiftung Warentest

So it’s no surprise that many people wonder whether switching to private health insurance is worthwhile. But is it truly beneficial? For those interested in first-class healthcare coverage, there are many providers and an overwhelming number of plan combinations. Stiftung Warentest tried to find the best value and evaluated 1 245 plan combinations.

The results were indeed surprising: Private health insurance does not automatically offer superior coverage compared to statutory insurance. Two-thirds of the plans, 861 in total, failed to meet our criteria or required policyholders to cover more than 660 euro in out-of-pocket expenses annually. These plans were excluded from our evaluation. Only 384 from 22 providers met our strict criteria. These plans meet our 16 criteria for well-rounded coverage and, in some cases, offer more than statutory health insurance.

How you can benefit from our test results

Find good health care at a reasonable price

Our downloadable PDF shows 41 recommendable insurance plans: 21 for employees and 20 for self-employed individuals. Among the insurers we compared you will find well-known brands like Allianz, Barmenia, Debeka and Huk. All plans that we display offer comprehensive coverage, starting from 649 euro per month for a healthy 35 year old person.

Overview of recommended plans

Our tables show the most affordable options for employees und self-employed with very good performance. All plans presented meet your 16 criteria for good private health care, match statutory insurance in all areas, and are often even better. Compared to plans with higher benefits you get more value for money. Some providers guarantee a premium-refund in case of a claim-free year, preventive checkups excepted.

Checklist: Mandatory health screening

To qualify for private health insurance, applicants must answer questions about their health status. Providing inaccurate information can lead to a loss of coverage. We guide you through the application process to ensure you answer correctly and avoid potential risks after unlocking the article.

Good and Affordable Coverage for Expats freischalten

What we did

After having identified 384 acceptable plan combinations for employees, self-employed and civil servants, we rated them. Since civil servant plans are usually not relevant for expats, we have excluded them from our tables.

After activation, you will receive the table with all recommended tariffs (as of January 2025) to download as pdf file.

What expats should consider before closing a contract

- Carefully evaluate your individual circumstances, including income, family size and length of stay, before deciding on private or public health insurance. Long-term financial implications, strict eligibility criteria and lack of family benefits may make it less suitable for you than for others.

- Be aware that private health insurance is only financially attractive at a young age. Insurance premiums will continue to rise in the future. Private health insurance is therefore particularly worthwhile if you join while you are young and healthy – and plan to leave Germany after a few years, before premiums become too high in old age

- Employees can only switch to the private health insurance system if they earn at least 73 800 euro gross per year. For self-employed individuals there is no limitation.

- Statutory health insurance does not require any health assessment, whereas private health insurance does. It is crucial to provide accurate information, as incorrect answers could result in losing coverage. We offer guidance on completing the application correctly.

Health insurance: What the law requires

- If you live in the EU, the European Economic Area or Switzerland, you do not need a visa to stay and work in Germany. On entering you only need to register at the local residents‘ registration office.

- Citizens of all other countries, who want to live, work or study in Germany for more than 90 days must apply for a visa before their entry. This is required to obtain a work permit. People from Australia, Israel, Canada, New Zealand, the Republic of Korea, the United Kingdom, Northern Ireland or the USA, can apply the visa after entering Germany at the Immigration Office.

- The visa or residence permit is issued by the authority along with the work permit. To obtain both, you must prove your residence in Germany with a rental contract.

- Foreigners from visa-required countries must provide proof of health insurance in order to obtain a visa for entry into Germany. The insurance must be valid for the entire duration of the planned stay. The insurance needs to meet the standards of statutory health insurance.

Statutory or privat health insurance?

- Foreign students in Germany are generally covered by statutory health insurance and benefit from a reduced contribution rate. Upon request, they may opt for private health insurance instead.

- Foreign nationals who take up employment subject to social security contributions in Germany are required to join the statutory health insurance system. However, if their annual income exceeds 73 800 euro (as of 2025), they have the option to switch to private health insurance.

- EEA citizens working as freelancers must join statutory health insurance if they were previously insured under a public health system in their home country. If they were privately insured, they must take out private health insurance in Germany as well.

- The cost of statutory health insurance is based on income. Contributions apply to all earnings up to the contribution assessment ceiling of 5 512.50 europer month (as of 2025), with employers covering half of the total contribution. For self-employed individuals, the minimum contribution assessment base is 1 248.33 euro per month (as of 2025). They must pay contributions on at least this amount if enrolled in statutory health insurance.

System comparison: Key differences between Germany‘s statutory and private health insurances

|

Statutory Health Insurance |

Private Health Insurance |

|

Eligibility |

|

|

Open to everyone, including apprentices, unemployed individuals, welfare recipients, and pensioners. |

Insurers can reject applicants based on pre-existing conditions, e.g. diseases. Only the basic tariff (offering statutory-level benefits) guarantees acceptance. |

|

Changing Providers |

|

|

Policyholders can switch between open statutory providers freely. |

Switching providers results in financial losses, as accrued benefits (e.g., old age provisions) are not transferable. |

|

Premiums |

|

|

Same contribution rate for young and old, healthy and sick. Family members (children and spouses without income) are insured for free. |

Individual premiums based on age, health status at entry, and coverage level. Higher entry age and pre-existing conditions lead to increased costs. Family members need separate policies. |

|

Contributions depend on income (up to an annual cap of €66,150 in 2025). Self-employed individuals with low income pay a minimum contribution. |

Not income-dependent. Premiums can increase over time, even if income decreases. |

|

Coverage & Billing |

|

|

Benefits are legally defined and uniform across all providers. Some insurers offer additional voluntary benefits. |

Coverage and benefits vary between insurers and policy types. |

|

Medical treatments and prescriptions are cashless, paid via the insurance card. Patients pay statutory co-payments (e.g., for physiotherapy or hospital stays). |

Patients pay upfront for treatments and medications, then submit claims for reimbursement. |

|

Some treatments have cost caps, such as fixed fees for doctors and rebate contracts for medications. Benefits can be changed, added, or removed by law. |

No cost limits for doctors and hospitals, but reimbursement depends on the chosen policy. Contractually agreed benefits are guaranteed for life. |

|

Legal Disputes |

|

|

Free appeals process. Legal cases follow social law, with lower financial risks – court and lawyer fees are capped by law. Losing a case only requires covering own costs. |

No statutory appeal rights. Cases follow civil law with higher financial risks – court and legal fees depend on dispute value and are not capped. Losing a case means covering both own and opposing party‘s legal costs. |

Good and Affordable Coverage for Expats freischalten

Diskutieren Sie mit

Nur registrierte Nutzer können Kommentare verfassen. Bitte melden Sie sich an. Individuelle Fragen richten Sie bitte an den Leserservice.